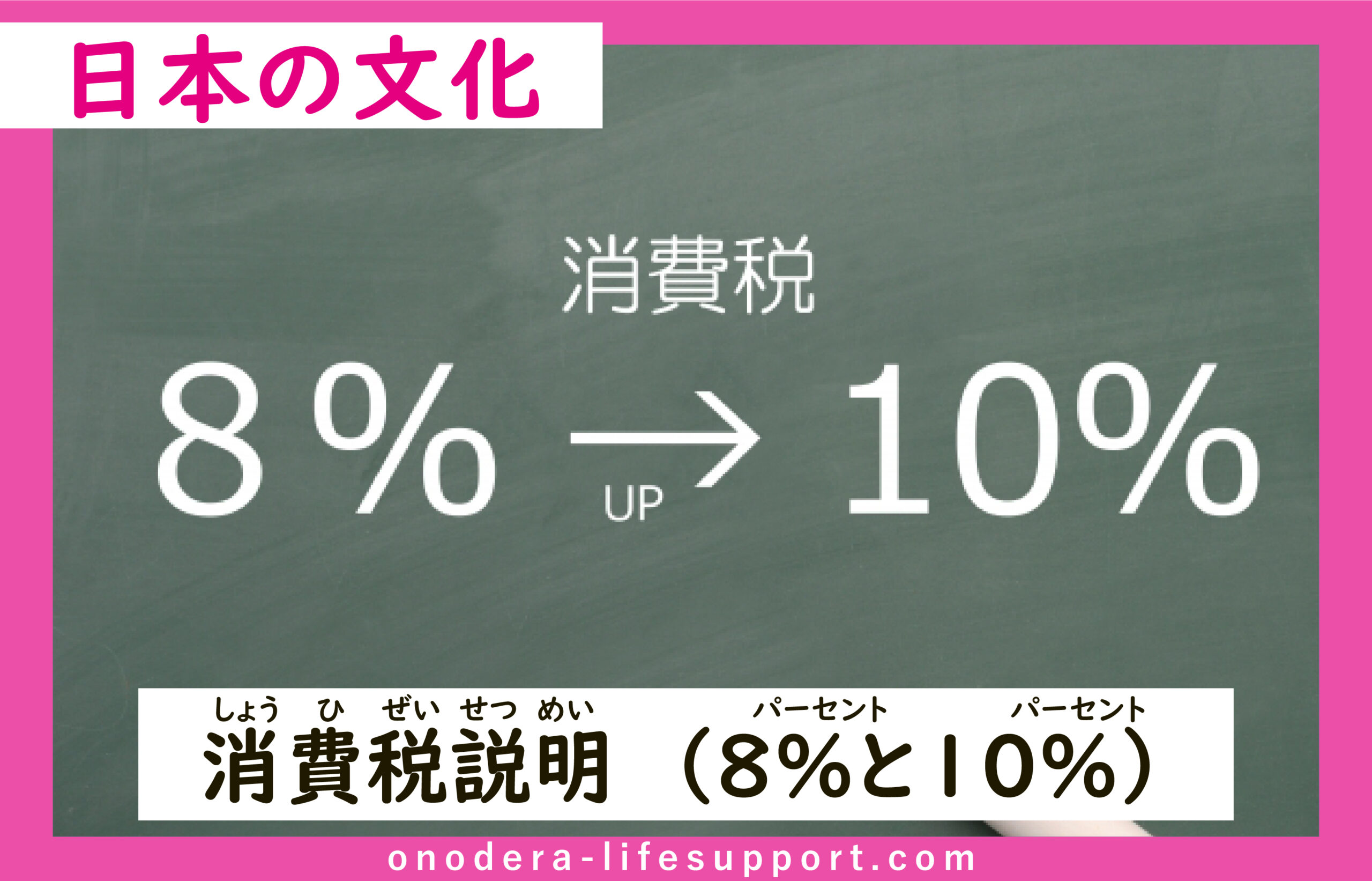

Japanese Consumption Tax (8% and 10%)

The first time consumption tax was introduced in Japan in April 1989. At that time, the consumption tax was at 3%, 5% in 1997, then increased to 8% in 2014.

On October 1, 2019 (Tuesday), the consumption tax was raised from 8% to 10%. Consumption tax rates have been raised and reduced tax rates have been implemented. According to the new reduced tax rate, “the consumption tax will be changed to 10%, but the consumption tax for food and drinks will remain at 8%”. Now do you know which items remain at 8% and which items will be taxed at 10%?

For daily necessities such as food and beverages (except for alcohol), the tax rate will remain 8%. Even though food and beverage products are at 8%, eating out and catering are not included and will be taxed at 10%. At a restaurant or convenience store, the tax will be different even if you buy the same item. For food eaten at a restaurant, the tax rate is 10%, while it is 8% for bringing it home. Please be reminded of this change of consumption tax, even if it is complicated.

For example, eating a meal at a restaurant that provides take-out service will be taxed at 10%, while eating the same food at a park will only cost 8% tax rate.

The change of the consumption rate from 8% to 10% depending on the situation, so please be aware of this every time you shop.